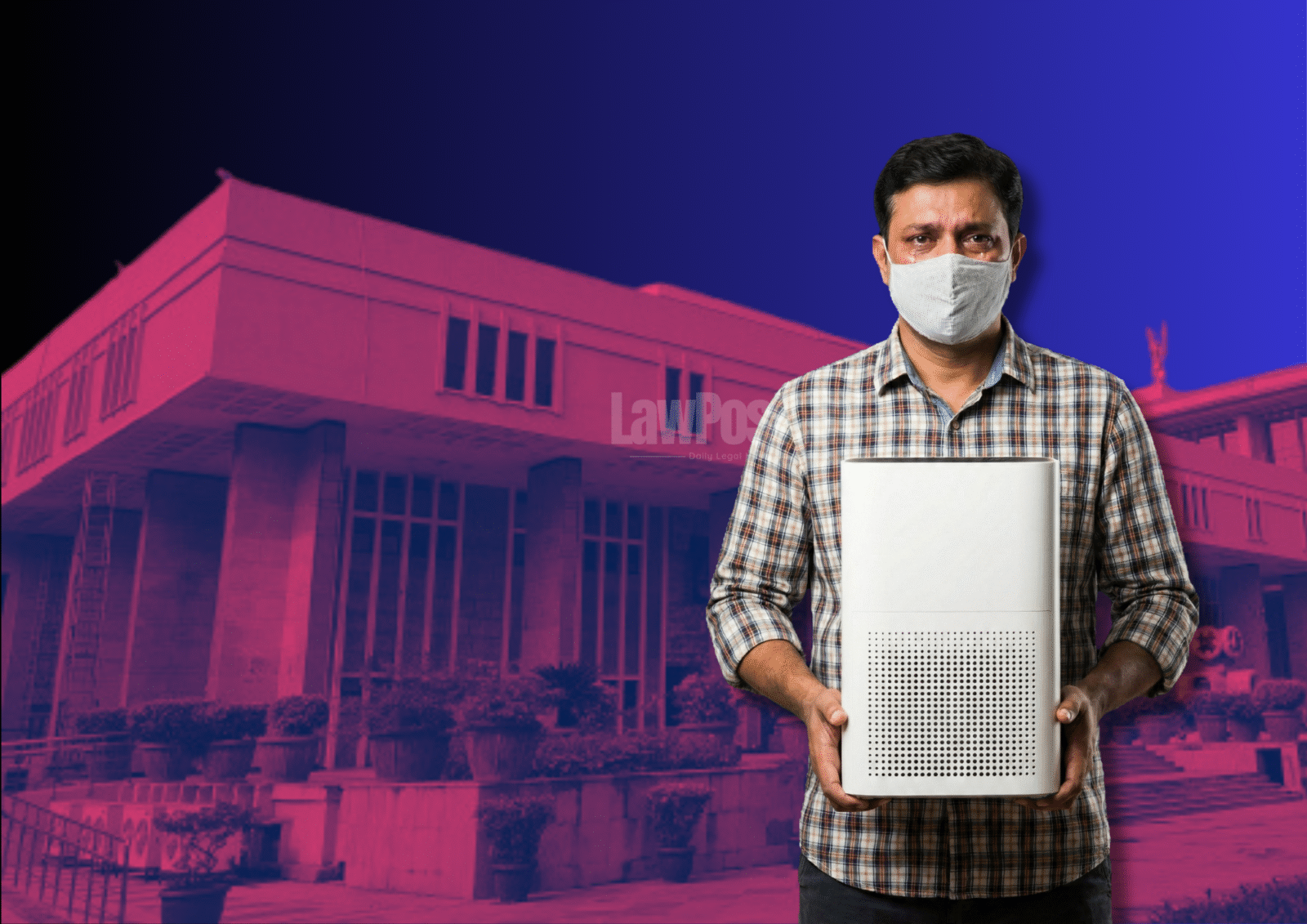

The Delhi High Court on Wednesday urged the Goods and Services Tax Council to convene an urgent meeting to consider reducing the Goods and Services Tax (GST) on air purifiers, citing the alarming deterioration in air quality across Delhi and the National Capital Region.

A Division Bench comprising Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela was hearing a petition seeking directions to classify air purifiers as “medical devices” and reduce the GST rate from 18% to 5%.

The Court observed that air purifiers can no longer be treated as luxury items in light of the ongoing public health emergency caused by severe air pollution. Emphasising the gravity of the situation, the Bench remarked:

“This is the minimum that you can do. Every citizen requires fresh air. If you can’t do it, the minimum you can do is reduce GST… How many times do you breathe in a day? 21,000 times. Just calculate the harm you are doing to yourself.”

The Court noted that a Parliamentary Standing Committee, in its December report, had already recommended that the government take a sympathetic view and either abolish or reduce GST on air purifiers and HEPA filters. Taking this into account, the Bench directed that the issue of lowering or removing GST be placed before the GST Council at the earliest.

“Considering the air quality situation in Delhi and nearby areas, we find it appropriate for the GST Council to meet at the earliest,” the Court said, adding that if a physical meeting is not feasible, the Council could convene through video conferencing.

The plea, filed by advocate Kapil Madan, argued that air purifiers perform a preventive and physiological-support function and therefore satisfy the criteria of a “medical device” under a 2020 notification issued by the Centre. The petition contended that imposing GST at the highest slab makes such devices financially inaccessible to large sections of the population, rendering the tax arbitrary and constitutionally impermissible.

During the afternoon hearing, the Centre informed the Court that any decision on GST rates must be taken by the GST Council, a pan-India body comprising representatives from all States, and that the meeting would have to be convened by the Finance Minister.

Recording these submissions, the Court directed the government to place the issue before the GST Council and seek instructions on how soon the matter can be considered. The case has been listed for further hearing on December 26, with the Court indicating that it will monitor compliance even during the court vacation.

Case: Kapil Madan vs Union of India & Ors – Available on LAWFYI.IO